The 2026 Effect

08 Dec, 20256 minutes

The 2026 Effect

Why London firms are quietly rebuilding corporate law teams ahead of the next deal cycle

For most of 2024, corporate felt like it was just… waiting. Stuck in that awkward pause where no one wants to make the first move. Deal flow slowed. Boards hesitated. A lot of lawyers stayed exactly where they were, even as searches for corporate solicitor jobs in London and broader London law jobs quietly dipped and then flatlined.

But over the last few months, something’s started to change. Not a rush. Not another big comeback moment. And definitely not another Oasis reunion tour. Just small shifts in behaviour. Quieter ones.

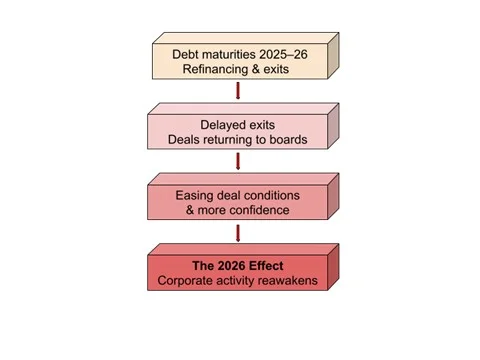

When we talk about the 2026 Effect, it isn’t about predicting the future or pretending anyone’s got a crystal ball. It’s just a way of describing what some firms have already started responding to. Because 2026 sits right where a few pressures overlap. Debt coming up for renewal. Deals that were parked during a messy couple of years and are now gradually finding their way back onto boards’ agendas. And a market that’s starting to loosen slightly, even if it’s doing it cautiously.

None of that happens overnight. And law firms know it. Which is why the early movement in corporate hiring doesn’t feel like hype. It feels like preparation.

For a deal cycle that didn’t go away. It just paused for a while.

Why 2026 actually matters

2026 isn’t important because we say so. It’s important because that’s where a few things that have been quietly building up start to line up.

A big chunk of leveraged and private equity-backed debt matures across 2025 and 2026. When that happens, companies don’t have many options. They either refinance, restructure or sell. And none of those decisions happen in isolation. They all create legal work.

At the same time, plenty of deals didn’t disappear over the last couple of years. They were parked while boards waited to see which way things would go. The problem is, that kind of waiting gets expensive. And eventually, decisions need making.

And while no one’s pretending there’s a dramatic switch about to flip, most major advisory firms are now suggesting transactions are starting to feel easier to get done again.

That knock-on effect is already shaping the corporate law market in London, particularly across corporate solicitor jobs in London and more niche corporate M&A jobs in London that rely on deal flow rather than steady advisory work.

That’s why some firms are acting early. Not because they’re suddenly optimistic. But because they don’t want to get caught on the back foot again. Not with announcements or fanfare either. Just practical steps. Rebuilding teams that thinned out. Planning capacity instead of scrambling for it.

How the 2026 effect is showing up in London

In London, this early movement tends to show up in a few places first.

West End practices are starting to feel busier around mid-market and sponsor work. Not just on the deal side, but in internal conversations about teams and headcount. The kind that don’t make press releases but do reshape departments over six to twelve months.

Boutique and mid-sized firms often move quicker. Some used the quieter period to consolidate. Others are now adding selectively, especially around the 2–6 PQE level, where deal experience really starts to compound.

Larger international firms are more measured, which you’d expect. But even there, there’s more quiet pipeline planning going on. Fewer knee-jerk hires. More deliberate recruitment for specific skills or sector exposure.

Offshore firms also tend to recruit London-qualified corporate lawyers when deal cycles start to stir. That timing usually lines up with broader 2025–26 pressures rather than short-term noise.

None of this shows up as a “corporate hiring boom” on LinkedIn or on job boards advertising London law jobs.

It shows up more quietly. In conversations. In planning meetings. In firms being slightly more open to talent they might have passed over a year ago.

As Charlie Simpkin at JMC Legal puts it:

“We’ve seen more new Corporate roles in the last month than in the previous six months combined – firms are preparing for 2026.”

That’s how early cycles usually look. Easy to miss if you’re only waiting for headlines.

For corporate lawyers, timing is the edge

Moves don’t land the same way when you make them early.

For NQs and junior associates, this is usually where more interesting opportunities start appearing first. Not always at the biggest firms. More often at West End or boutique practices rebuilding teams and offering broader deal exposure.

Those roles don’t shout the loudest. But they often give faster learning and earlier responsibility than holding out for one “top-tier” name.

For mid-level associates, roughly 3–6 PQE, this phase can be a real window. Teams are being shaped, not patched. Firms are thinking about future capacity, not just reacting to what’s on fire today.

We’re seeing that reflected in the types of corporate solicitor jobs firms are quietly briefing legal recruitment firms in London to handle, long before roles ever hit the public market.

That can mean:

- Better choice of team culture

- More space to step into leadership on deals

- Less panic hiring, more considered moves

For those weighing up offshore or in-house roles, timing matters there too. These moves tend to happen before deal volumes peak, not after.

By the time the market looks busy again, most of the best structured moves have already happened.

Inside firms, hiring is shifting too

Most firms don’t get caught out because they didn’t see change coming. They get caught out because they waited for certainty.

We saw that after the pandemic. Firms that held off hiring until deal flow was clearly back ended up stretched, reactive and expensive to run. Teams burned out. Clients noticed the strain long before some firms admitted it internally.

The ones acting earlier this time aren’t being optimistic. They’re avoiding a repeat.

In cycles like this, firms tend to lean more heavily on specialist legal job agencies in London, not for volume, but for access to candidates who aren’t actively applying for London law jobs right now.

Moving early doesn’t mean over-hiring. It means making a few targeted decisions sooner. Filling gaps. Strengthening capability before the pressure hits. That’s where recruitment changes too. It becomes less about who’s available right now and more about who might move at the right time.

Before It Gets Loud

The 2026 Effect isn’t really about a year. It’s about timing.

Deals take time to build. Teams take time to shape. And the firms that move earlier don’t tend to broadcast it. They just stop having to scramble later.

For lawyers, it’s the same thing. By the time the market looks busy, most of the smartest moves have already happened. Not because people rushed, but because they paid attention sooner.

If you’re a corporate lawyer thinking about your next move, the conversation doesn’t have to be about jumping tomorrow. Sometimes it’s just about understanding the timing and where you sit in it.

And if you’re a firm planning for what’s coming, it might not be about hiring more people. It might be about hiring the right people before everyone else starts looking.

That’s where we tend to help best.

As one of the legal recruitment firms in London focused on corporate law hiring, we’re often involved long before roles ever appear publicly as corporate solicitor jobs. So, if you want to have that conversation, without noise or pressure, just reach out. We’ll tell you what we’re seeing and what it means for you.

Get more insight into London’s legal market here:

https://www.jmc-legal.com/resources/blog/corporate-law-salaries-in-london-2025/

https://www.jmc-legal.com/resources/blog/what-its-really-like-to-train-at-a-us-law-firm-in-london/

https://www.jmc-legal.com/resources/blog/greater-london-could-be-your-best-legal-career-step-yet/